Retail marketing scientists have mastered the art of seduction. They make a living by influencing your purchasing decisions and, on occasion, roping you into buying something you really don’t need. They have a myriad of analytics at their disposal, and they’re not shy about using them to tempt you into abandoning all rational behaviour and making impulse purchase decisions – the kind that result in shocking credit card bills at the end of the month.

Marketing scientists have many tricks up their sleeves, but the most common way they get us to drop our purchasing defences is by provoking us with sales. Sales have a powerful allure, appealing to restrained and uninhibited shoppers alike.

Running of the brides

One of the most extreme examples of how far sales can drive otherwise rational people to total shopping madness is Filene’s Basement’s ‘Running of the Brides’ sale. (The reference to Spain’s ‘Running of the Bulls’ is entirely appropriate, given the frenzy this sale invokes.) Filene’s Basement is now closed, but while in business, its annual sale event attracted thousands of brides-to-be from around the world, all eager to find their dream designer dress at a rock bottom price. And who could blame them? Wedding gowns worth thousands of dollars were discounted as low as $249, to a maximum of $699. The eager shoppers assembled their own teams and created strategies for grabbing and trying on as many dresses as possible on event day. At 8:00am the pistol was fired and the doors flew open, launching an all-day bridal war that sent silk and lace flying, and sent etiquette right out the window – all for the sake of bargain basement pricing.

Hopefully, most people won’t be involved in a brawl over retailers’ wares. But we all feel that inner itch when we learn about a good sale. Marketing tactics have become so slick these days that retailers can regularly convince us to part with our money in unplanned ways and even leave us feeling happy about it.

How fonts and 9’s get you to buy

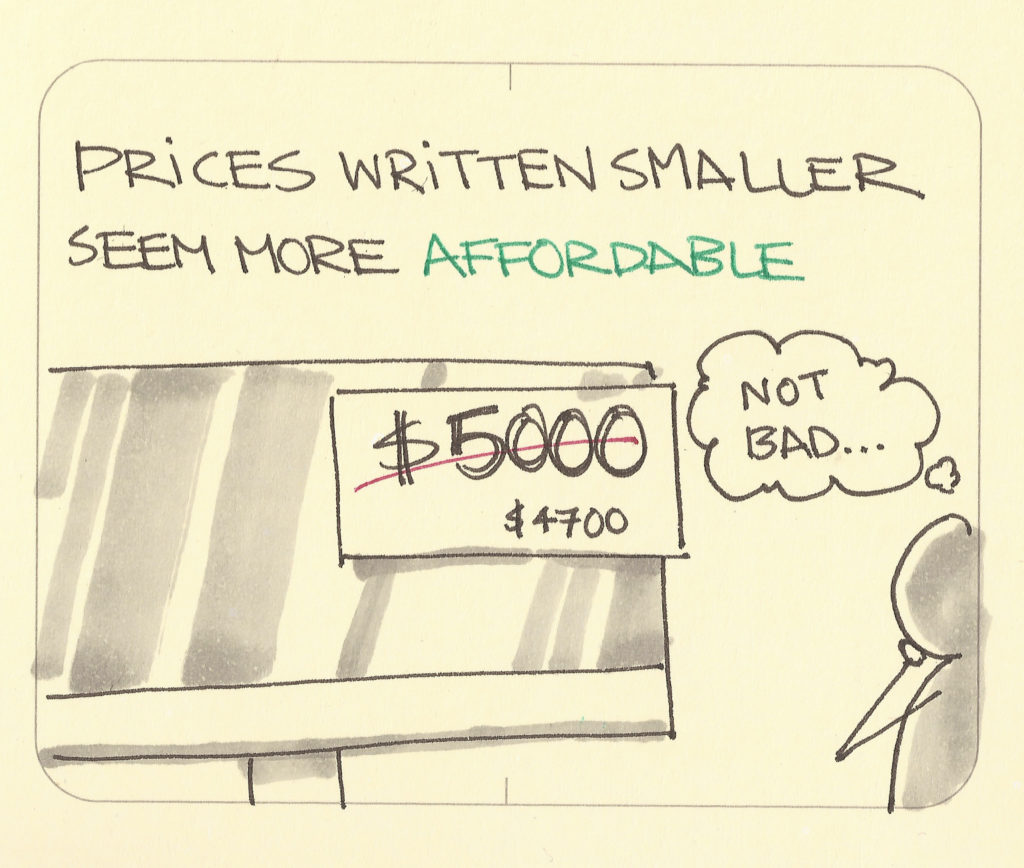

Sketch credit Jono Hey via www.sketchplanations.com

Think of how retail marketing scientists manipulate pricing signage during sales. They commonly use signs that emphasize the original price in big font and deemphasize the sale price in small font. They do so because research has shown that when the sale price is presented in smaller font, it gives the illusion of being more affordable and triggers impulsive purchases. It’s a subtle but effective way of swaying our willingness to spend.

Of course, sales aren’t the only way retailers lure us into spending more. There’s the ever-popular “number nine” ploy. In the past, whenever I saw items marked at $9.99 instead of $10, I used to say to myself, “Who do they think they’re fooling?” But like most people, I underestimated the power of the number nine. As William Poundstone points out in his book Priceless, eight different studies show that setting price points that include the number nine increased sales by 24%!

Pricing decoys

Pricing decoys are another way retailers get you to part with more money than you planned on. In his book, Predictably Irrational, behavioural economist and professor Dan Ariely demonstrates how a large magazine successfully employed a strategy called the “decoy effect” to increase revenue from subscription sales. Prospective subscribers were given three choices:

Choice #1: Web-only subscription for $59

Choice #2: Print-only subscription for $125

Choice #3: Web + print subscription for $125

At first glance, the middle price point appears to be superfluous. Why would anyone buy a print-only subscription for $125 if they could get a web and print for the same price? Ariely tested the price points with MIT students and found that 16% of students chose option 1 and 84% chose option 3; not surprisingly, none chose option 2.

Then Ariely did something really interesting; on the assumption that having a decoy price (option 2) was influencing people’s choices, he removed the decoy and retested the price points. This time, the subscription choices were as follows:

Choice #1: Web-only subscription for $59

Choice #2: Web + print subscription for $125

With the decoy removed, the option that had previously been the most popular – the more expensive print + online access subscription – suddenly became the least popular choice. Only 32% of those surveyed chose the more expensive option, with 68% selecting the online-only subscription. Clearly, the middle price point wasn’t superfluous; it was smart marketing that made option 3 look more attractive to subscribers.

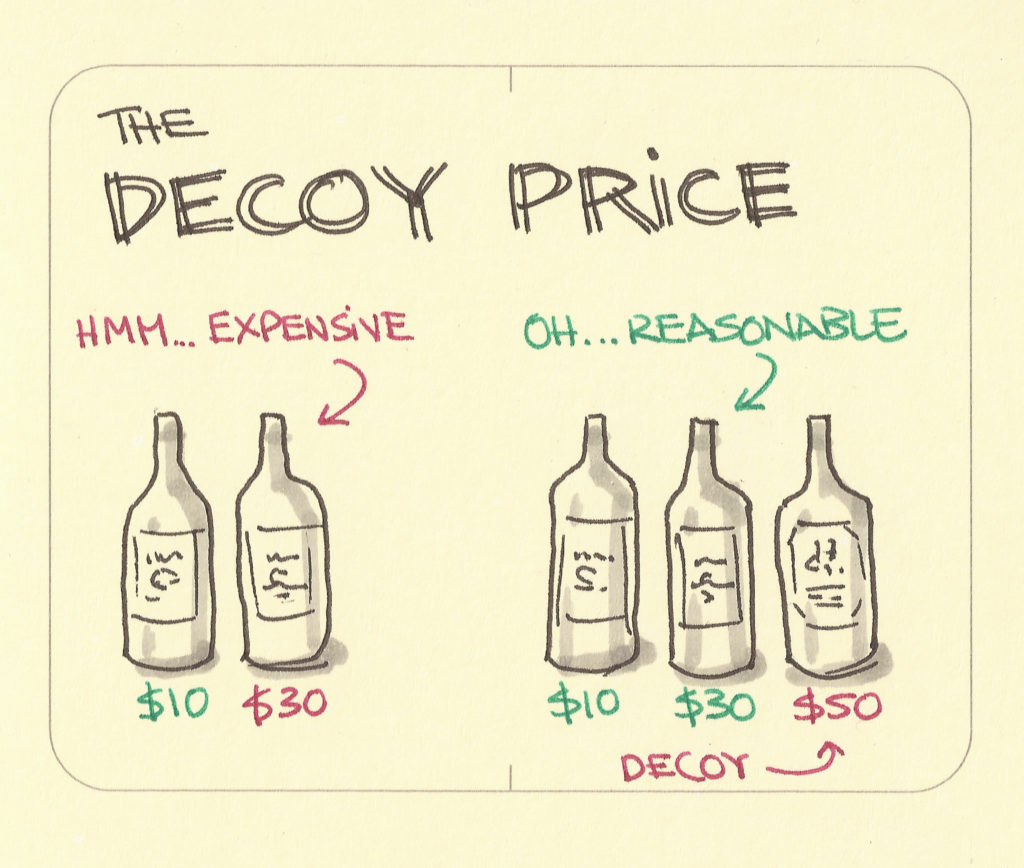

Sketch credit Jono Hey via www.sketchplanations.com

The decoy effect applies to other items as well. Take wine, for example; we end up spending more if we are given three different price points as opposed to two. If one bottle is cheap, say $10, and the third bottle is expensive, ringing in around $50, then suddenly a $30 bottle seems reasonable – even if the customer only intended to spend $15-$20 at the most.

Retailers aren’t about to stop using the tried-and-true tricks that have worked for decades. Ultimately, it’s up to us resist their persuasion and take responsibility for our spending. But there are a few “tricks” of our own we can employ to help protect our wallets and preserve our sanity. If you’re easily enticed to spend money on sales items, or often succumb to manipulative pricing, you could save a lot of money by following these two rules of thumb:

Rule #1: Follow the 24-hour rule

Retailers count on the fact that we get into a ‘hot’ state when we see an item we want to buy. It clouds our judgement and makes us irrational about our fiscal responsibilities. If you find yourself in this predicament, the best thing you can do is abide by the 24-hour rule. Here’s is how it works: Don’t deny yourself the item altogether. Instead, tell yourself “I can buy it if I still want to after 24 hours.” Let’s face it, the item likely isn’t going anywhere fast, and even if it sells out, you could probably find it online. There’s no harm in waiting a day before buying a product, but there is a lot to be gained.

By following the 24-hour rule, you give yourself time to get into a ‘cool’ state, one where you can resist the impulse buy and embrace your inner accountant. If you find that at the end of 24 hours you still want to make the purchase and have rationally determined that it’s an investment worth making (that is, it fits into your budget), then go ahead.

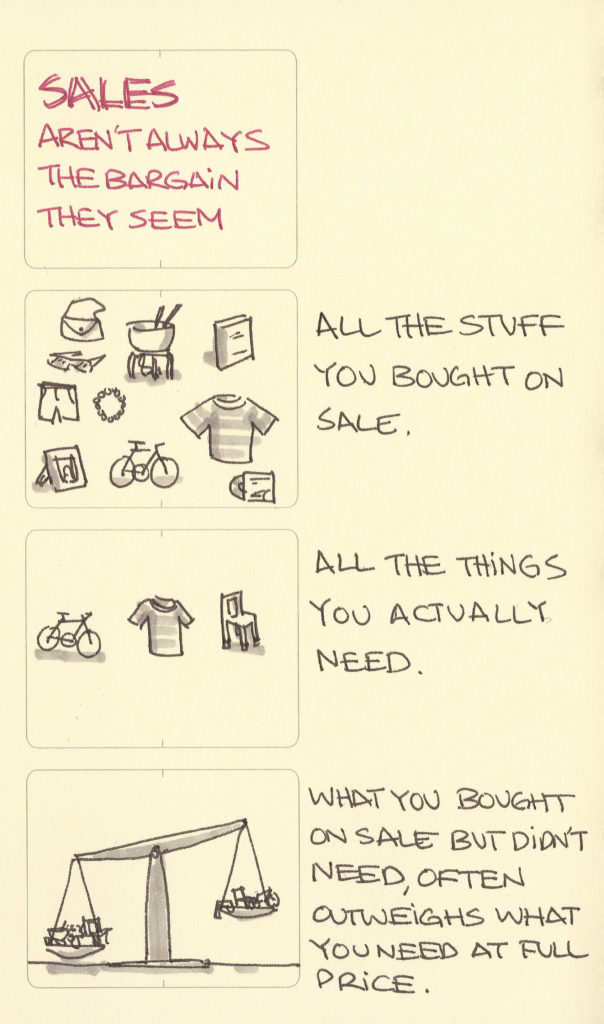

Sketch credit Jono Hey via www.sketchplanations.com

Rule #2: Only pay full retail

This rule might seem counter-intuitive, but consider this: If you added up all the unneeded items you bought on sale (like clothes in your closet that still have tags attached, or toys and tools in the garage that have never been used), you’ll probably find that the cost outweighs what you would have spent if you’d only bought things you really needed, even at full retail price. If you consciously walk away from every sale and always pay full retail prices – on items you really need – your finances will almost certainly come out on top. Keep in mind I’m not talking about toilet paper and toothpaste; those daily necessities are great to purchase on sale. It’s those big ticket items, like high-tech toys or designer duds that you should look to buy only when you really need them, not just because they’re marked down.

When there’s a “60% off” sign dangling in front of you, it takes a lot of willpower to resist. You may need some practice, and a lot of dedication, to be able to consistently respect your financial limits. But if you follow the 24-hour rule and commit to paying full retail price, the “60% off” sign loses a lot of its persuasive power. Don’t submit to temptation; take control of your spending habits, and your financial future will remain yours to dominate.

Comments are closed.