Becomin’ Hip in Brooklyn

Eight years ago I ended up in a wheelchair for 6 weeks. Here’s what happened…

One day out of the blue my hip started killing me. I was walking like a penguin. I’m usually good at “pushin’ through the pain” but it was so bad we cancelled our weekend getaway to the in-laws. BTW, this wasn’t just an excuse not to see the in-laws…I actually really like them.

Fast forward 3 weeks. I was drugged up, stuck in a chair in my Brooklyn living room, and barely able to move. If I shifted even half an inch the wrong way it felt like someone was driving a nail down my whole leg. All the pain meds in the world didn’t seem to help. My wife had to push me in a wheelchair to my MRI. I felt every little bump on the sidewalk. Do you know how many bumps are on Brooklyn sidewalks? I do. I hated every one of them. Ouch.

A Stretch a Day Will Keep the Doc Away

The following week I got into a top surgeon in Manhattan. He told me that my MRI showed swelling in my sacroiliac joint (SI joint). I didn’t know at the time, but the SI joint is pretty important since its main job is to absorb shock. If you’ve ever driven a car with no shocks, you get where I’m coming from. No wonder I screeched in pain every time we went over a pebble on the sidewalk. I was willing to do almost anything to get the pain to go away.

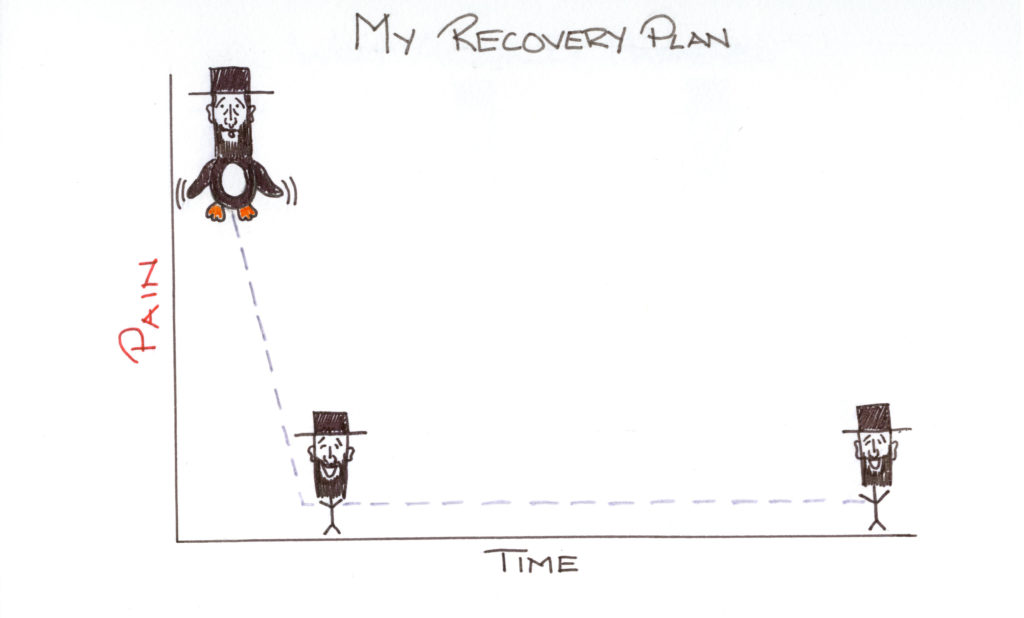

The doc told me that the pain would go away and never come back. I just needed to do one thing first. Was it surgery? More mind numbing pain meds? A long scary needle in the back? Nope, none of the above. Just one simple stretch every day for 15 minutes. That’s it, 15 minutes a day and I would be pain free. No brainer! I swore up and down never to miss a day.

I became religious about it. Every day without fail, I did my little stretch. And the doc was right, I started to feel better. Within a few weeks I ditched the wheelchair and I was able to get out of the house. Eventually I had a full recovery and was back to my old self. Yay!

Rerun: March of the Penguin

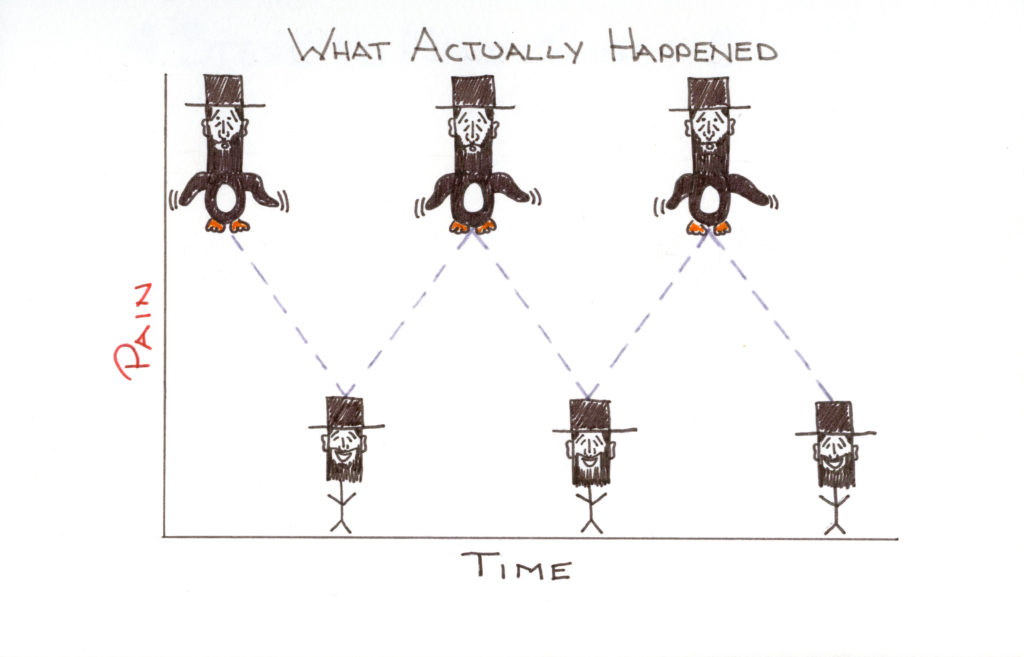

Then a funny thing happened. The longer I was pain free, the less frequently I did my stretches. Eventually I stopped the stretches all together. I know, I know: smooth move ex-lax. The doctor’s words started to fade and I thought that I was over the pain for good. Oy veh, was I wrong. One morning, I woke up and felt that pain in my hip and started to do the penguin again. I kicked the stretches into high gear and I thankfully stopped waddling after a month.

You would think that I finally learnt my lesson, right? Nope. I got stuck in this waddle/stretch yo-yo for a year! I couldn’t stick to a silly 15 minute regime for the life of me. Then I found stickK. An online tool that’s scientifically proven to triple your chances of success.

A Trick to Make Things stickK

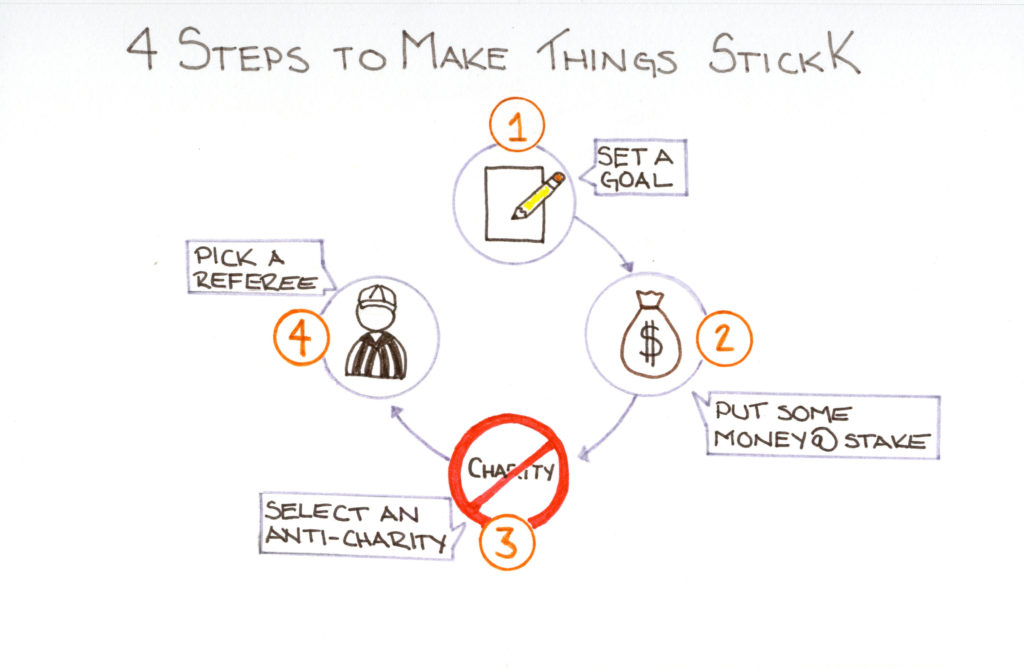

I’m sure you’ve heard a million tips and tricks to make you successful, but how many times did they actually work? StickK’s different. Not only did it get me out of a wheelchair, it also helped me exercise regularly and stick to a budget. Listen to these four little steps. They’ll make a huge difference in your life:

- Set a goal. In my case to do daily stretches. But you can also try to lose weight, quit smoking, go to the gym, and as I will tell you soon; how to stick to a budget.

- Put some money at stake. I chose $40 per week. FYI: you don’t need to put cash on the line, but putting some money where you mouth is will increase your chances of success.

- Select a charity you bitterly hate. Choose an organization you’ll forfeit your money to if you mess up on your goal. Here are a few anti-charity options: Educational Fund to Stop Gun Violence, The NRA Foundation, The Liverpool Fan Club, The Manchester United Fan Club, and the George Bush Library. I don’t want you to judge me here, so I’m not going to tell you flat out which one I chose.

(Subtle Hint: It’s definitely not a football club. Unless football clubs have target practice.) - Pick a referee. An accountability partner. Someone you know who will send your money to the anti-charity if you falter in a weak moment. I choose my office buddy Harold. A straight shooter who would pull the trigger if needed (no pun intended, okay, maybe it was).

I can’t tell you the amount of times I promised myself that I’d keep up those stretches and failed. I always put them off and gave into daily distractions like skydiving, climbing Mount Everest, and conquering the world. Okay, they might not have been that important… But seriously, stickK helped me beat more common procrastination so I could reach my long term goals.

Stop Stressin’: 3 Budgeting Tips that Work

Quick Q for you: Are you scared to open your credit card bill? Is your line of credit too much to even think about? And the kicker is you make good money! If you’re thinking “Ya, that sounds about right” I know you’re in more pain than when I was stuck in my wheelchair. I’ve been there, done that too.

Here are three simple financial exercises that helped me get out of my financial rut and I’m sure they’ll help you too:

- Track your daily discretionary spending: This is the easiest way to change your financial behaviors. Hands down. You’ll be amazed how fast all those seemingly “insignificant” purchases add up to big bucks. Say you spend $22 a day on your morning coffee and daily lunch. That adds up to over 8K a year! And how often do we pull a twenty out or tap our credit card without thought? Putting it all down on paper at the end of the day, everyday, will motivate you to change your spending now. Estimated time: 15 minutes daily.

- Use financial software: Wonder where it all goes? Wanna feel more in control? There are a ton of financial software programs that do an awesome job (Quicken, Banktivity, and Mint.com are all popular these days). Everything you want to track is right there in front of you: bank accounts, loans, and credit cards, all in one organized place. If you’re into knowing all about the numbers, you can slice and dice the facts like a pro. If you’re more into the “big picture,” you can step back and see it all. Who doesn’t want all their financial data in one place? Once it’s up and running, you’ll be able to make educated decisions that could add to your bottom line. Estimated time: 2 hour set up then 30 minutes every two weeks.

- Pay your bills on time: I know, this sounds elementary. But I’ve seen so many people needlessly waste their money in interest and late fees. Especially when there’s enough money in the account. Simple life hack: Make a concrete rule that all bills get opened and paid on the day the mailman drops them off. Don’t schlep to the bank, just use online banking or mobile app. And voila, no more money thrown out the window.

Estimated time: 8 minutes per bill.

Just like my stretches, these budgeting tools don’t take a lot of time. But it’s one thing to say and another to do. Success always starts with a plan. Using stickK will help you battle the urge to procrastinate in all areas of life. Look, it helped me get out of a wheelchair. Why not try it out to get your finances back into shape too?

I’d like to know what the stretch was thay cured you or was that just fiction?

100% true Paulee. Here’s a link to a picture of the stretch (with an arrow pointing to it.)

Link: https://www.avrahambyers.com/wp-content/uploads/2018/01/2018-01-16_21-42-52.jpg

Happy stretching!