If I gave you $500 a month to put towards your debt, what’s the best way to use it? Should you chisel away at the debts with highest interest rate? Or knock off the smaller ones first?

I’m going to take you through two strategies to tackle your debt – Debt Avalanche vs Debt Snowball — and I’ll show you which one works best. The answer might surprise you.

Method #1 – Debt Avalanche

This strategy prioritizes paying off your debts from highest to lowest interest rates in order to minimize the amount of interest you pay.

Here’s how it works:

Step 1: Make minimum payments on all your debts

Step 2: Allocate all extra money to the debt with the highest interest rate

Step 3: Once that debt is completely paid off, focus on paying off the debt with the next highest interest rate

Step 4: Repeat until debt-free

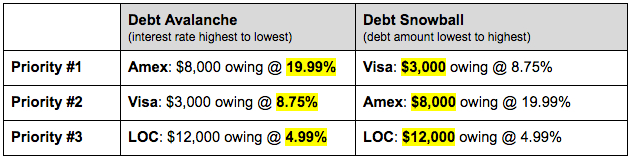

Let me give you a real-life example. Imagine these are your debts:

- $12,000 line of credit at 4.99%

- $8,000 owing on Amex at 19.99%

- $3,000 owing on Visa at 8.75%

According to the Debt Avalanche method here’s how you should prioritize where you put your extra $500 of income:

- Priority #1: $8,000 owing on Amex at 19.99%

- Priority #2: $3,000 owing on Visa at 8.75%

- Priority #3: $12,000 line of credit at 4.99%

Your Amex might not have the biggest debt, but it does have the biggest interest rate. By paying off this card first, you’ll drop your debt faster and pay less total interest to the banks.

Sounds great, right? Before you decide the Debt Avalanche method is right for you, let’s talk about the Debt Snowball.

Method #2 – Debt Snowball

This method tells you to pay off your debts from smallest balance to largest — ignoring your interest rates. The idea is that paying off your smaller debts sooner will give you confidence and financial momentum to stick with your plan to the end.

Using our example above, here’s the order you’d prioritize paying off your debts:

- Priority #1: $3,000 owing on Visa at 8.75%

- Priority #2: $8,000 owing on Amex at 19.99%

- Priority #3: $12,000 line of credit at 4.99%

This behavioral-based method harnesses the power of quick wins. Once you pay off that first debt, that small win will spur you on to knock out the next debt. The momentum will build and before you know it, you’ll be debt free.

Let’s Look at the Numbers: Debt Avalanche vs Debt Snowball

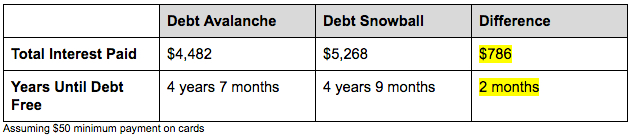

Now that we’ve reviewed the two main strategies to get you debt free, let’s lay out exactly how much interest you’ll pay and the time it’ll take for you to achieve your goals.

Just to recap, here’s a side by side comparison of how they’d be paid off by priority:

Priority Chart

So which method will get you ahead financially? Let’s look at the breakdown of interest accumulated.

Total Time & Interest Paid

If you choose the Debt Avalanche method, you’d be ahead $786 in interest charges and pay off your debts 2 months sooner.

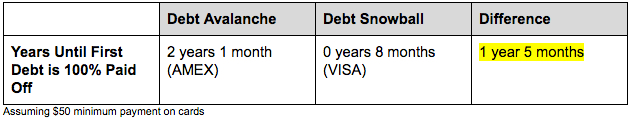

But hold your horses. Before your jump on the Debt Avalanche bandwagon, let’s look at how long you’d have to wait to pay off your first debt…

Time It Takes to Pay Off First Debt

If you chose the Debt Snowball method, you’d pay off your first debt in only 8 months — versus 2 years and 1 month using the Debt Avalanche method.

Which method should you choose?

Mathematically, it makes more sense to follow the Debt Avalanche method. And I logically understand that.

But finances are 80% behavioral and 20% numbers. That’s why I always recommend starting with the Debt Snowball approach.

And the research backs me up. Kellogg researchers — the University, not the cereal — found that consumers who used the Debt Snowball method were more likely to eliminate their entire debt balance.

And that makes sense to me.

Quickly seeing those credit cards come back with a zero balance will give you the stamina to power through your debt repayment.

There isn’t a better motivation than that.

Now it’s your turn…

Which method makes sense to you?

Are you an Avalanche or a Snowball type of person?

I’d love to hear your opinion. Join the conversation and leave a comment below ;).

Awesome article Avraham! So if the debt amount varies between your loans, then you should start with the smallest debt amount and build confidence with the snowball method. But what if your loan amounts are all similar in size, then it would make more sense to do the debt avalanche method as payoff times are the same/similar?

Wesley, awesome question. If your debts are similar in size, you’re right, it’s best to start paying with the Debt Avalanche. For example, if you owe $5,000 on your Visa @ 9.99% and $5,500 on your Amex @ 19.99%, you’re better off paying the Amex — even though it’s not your smallest debt. The time saved won’t be huge but the interest saved might be. Here’s a link to a great calculator that compares Avalanche vs Snowball: https://undebt.it/. Enjoy 😉

I would go for the Debt Avalanche method as I get motivated by numbers not by paid up credit cards.

However most people are the opposite so I understand your point.

Thank you for all your great articles.

keep it up, I really enjoy them.

Ya, you gotta know yourself ;). One other idea I didn’t mention is what I call the “1-2 knockout.” Basically, start with the Debt Snowball, and knock out the smallest debt first. That’ll get you motivated . Then start swinging for the larger ones with higher interest rates. It’s the best of both worlds.

Debt avalanche. The idea that one needs to pay so much more interest …….

Possibly one could split the payments $400 and $100 and allocate them towards paying the easiest in tandem with the first priority the one with the highest interest rate.

That first pic is so very Indiana Jones 🙂

That’s a great idea. Ya, I know I look very Indiana Jones’ish. Must be the hat!

Good article, Avraham. This is exactly the discussion I go through when clients are trying to pay off debts.

Thanks Ed!

I will choose the avalanche method because when you have debt you have to pay it asap and with the minimum interest to the bank. This will put in your pocket a saved amount .This is why I will pay the most calculated interest first.

snowball looks fake. sorry bout that.

I’d go avalanche. How’s the family?

Hey David. Lol, you’re so funny. Ya, the snowball does look fake. When we did the photo shoot, there wasn’t a flake on ground. So I put my rookie skills to work on photoshop. But the Avalanche pic was real!

Thanks for weighing in on your “avalanche” choice ;).

And the family’s great. Especially Chaya — my 3-year-old daughter — who insists the snowball is real and wants one too ;).

Avraham,

I think it depends on the individual and what motivates them. I understand the psychology of the debt snowball method however it appears to me that the only tangible motivational factor is the single metric of the completed debt payment. However if one introduces other metrics that can impact their motivation while using debt avalanche, they will be ahead mathematically and psychologically and maintain their motivation to continue paying debt. For example, if one can create a sort of notional account where the accumulated interest saved is calculated monthly on the debt avalanche method that may be just as motivational. I am not an expert on behavioral changes, but I believe it involves many aspects of our self needs including psychological, social, cognitive, and emotional factors that impact our decisions. The key is to find the one thing that will motivate you more, or that you find more important than the behavior you are trying to change. Thank you for your insight. Its always refreshing to hear other viewpoints. BTW…Snowball looks great!

Phil, bang on when you said “The key is to find the one thing that will motivate you more, or that you find more important than the behavior you are trying to change.” Part of getting rid of debt is to find those personal motivations that’ll get you to take action and change your financial behaviors.

Alternatively, I also like the “1-2-debt-knockout”. Basically, start with the Debt Snowball, and knock out the smallest debt first. That’ll get you motivated. Then start swinging for the larger ones with higher interest rates. It’s the best of both worlds.

And thanks for believing in my snowball ;).

I’m a numbers based person and select the avalanche method, however money is emotional and therefore I must show flexibility with my clients to keep them motivated! However, when the snowball method is implemented, I ALWAYS have them call the credit card folks and request a rate reduction on their interest. Many individuals don’t know that it is totally possible to drop a few points every 6 months – it just takes a phone call. This makes everyone feel a little better about the snowball. Great article and nicely written! Love the personable approach.

Roxanne, thanks for the tip! It’s a great idea to call and request a reduction in rate on your credit card. One time I did that, and they gave reduced my rate to 4.25%. And it wasn’t just a “promo” for a year. That was actually my rate because I had a stellar credit score. It pays to call. The worst thing that could happen is they say “no”. But you’ll never know unless you try ;).

Hi Avraham,

Thank you very much for this great article. This is the first time I’ve heard about the comparison between an Avalanche and snowball way of handling your credit card debts. Again, thank you for sharing your thoughts.

You’re welcome Lourdes! Glad you enjoyed ;).

Or you can combine the debt on the lower interest cards, paying off the higher interest faster. Then if any balance remains on the higher interest card, pay it off first. Then pay off the next highest interest rate card. Then continue to get rid of your debt.

I had to borrow from credit cards to purchase my house some years ago.

I HATE debt. So that’s what I did to get rid of it. It worked. Only debt now is mortgage. ☺

Keep paying to get rid of it. I appreciate the avalanche theory.

Thanks Joyce! I understand where you’re coming from 100%. I “hate” debt too ;).

The people reading this are already motivated to do well with money, I would guess. The snowball method with it’s small victories is what people need if they have been habitually bad with money and have lots of unpaid balances, (See Dave Ramsey). Motivation to change bad money habits with small victories (Snowball) are more important than the bottom line of saving some money and a few months (Avalanche). I would go on to guess that consolidation loans are for people with bad money habits who attempt the avalanche method.

You’re right Keith, small victories are what helps people change their habits. Thanks for weighing in Keith.